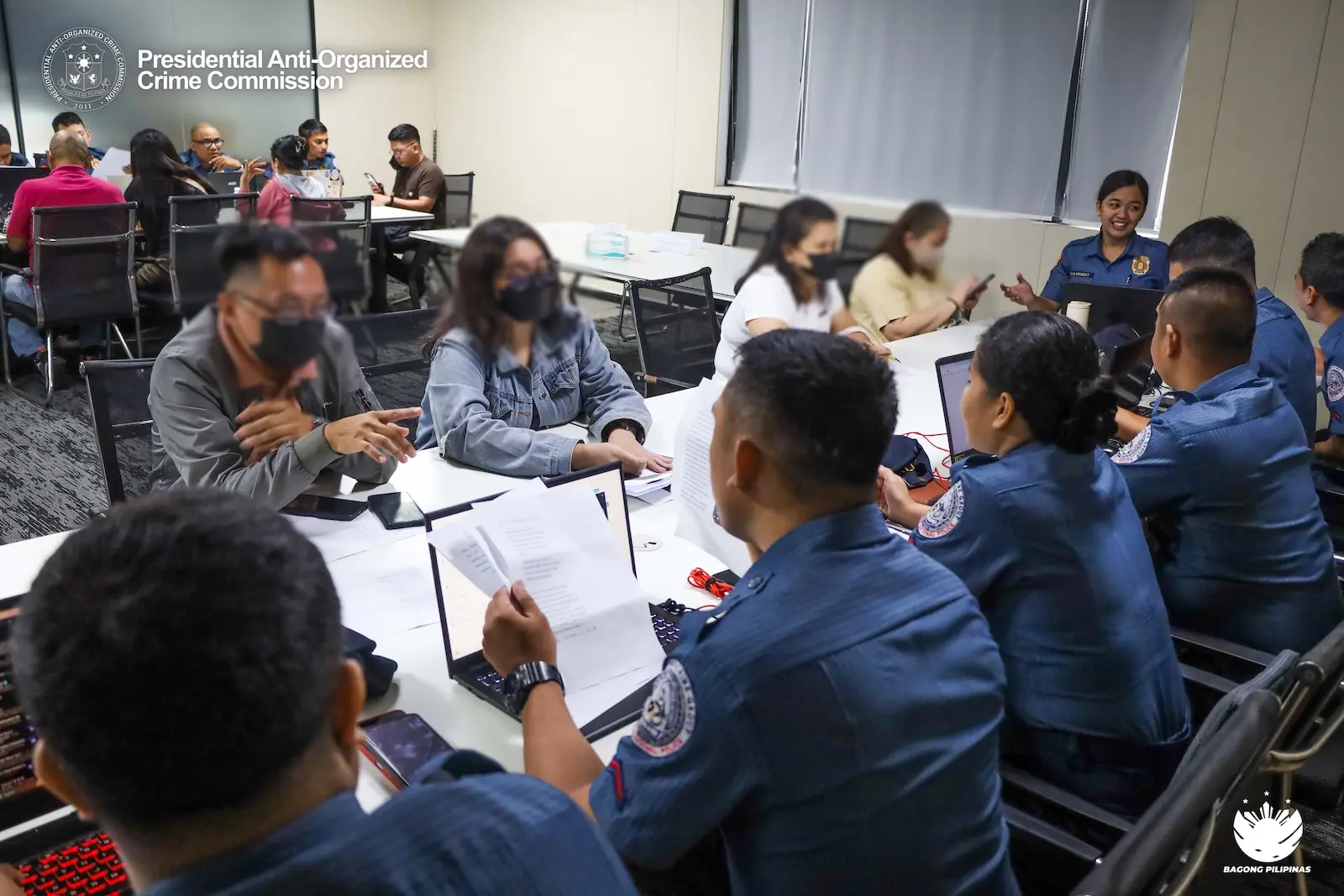

On June 16, several government agencies launched a formal campaign cracking down on online lending applications (OLA) exploiting Filipino users. According to the Presidential Anti-Organized Crime Commission (PAOCC), they received more than 13,000 regarding abusive OLAs in April and May this year.

Joining PAOCC in the campaign are the Philippine National Police’s Criminal Investigation and Detection Group (PNP-CIDG), the Securities and Exchange Commission (SEC), and the National Telecommunications Commission. They have established a “one-stop shop” for victims of OLAs to file complaints, and are investigating potential links to illegal POGO operations.

PAOCC said that around 100 complainants have given PNP-CIDG their sworn statements and will work with authorities to build cases against OLAs for abusive lending practices, “outrageous fees,” and privacy violations.

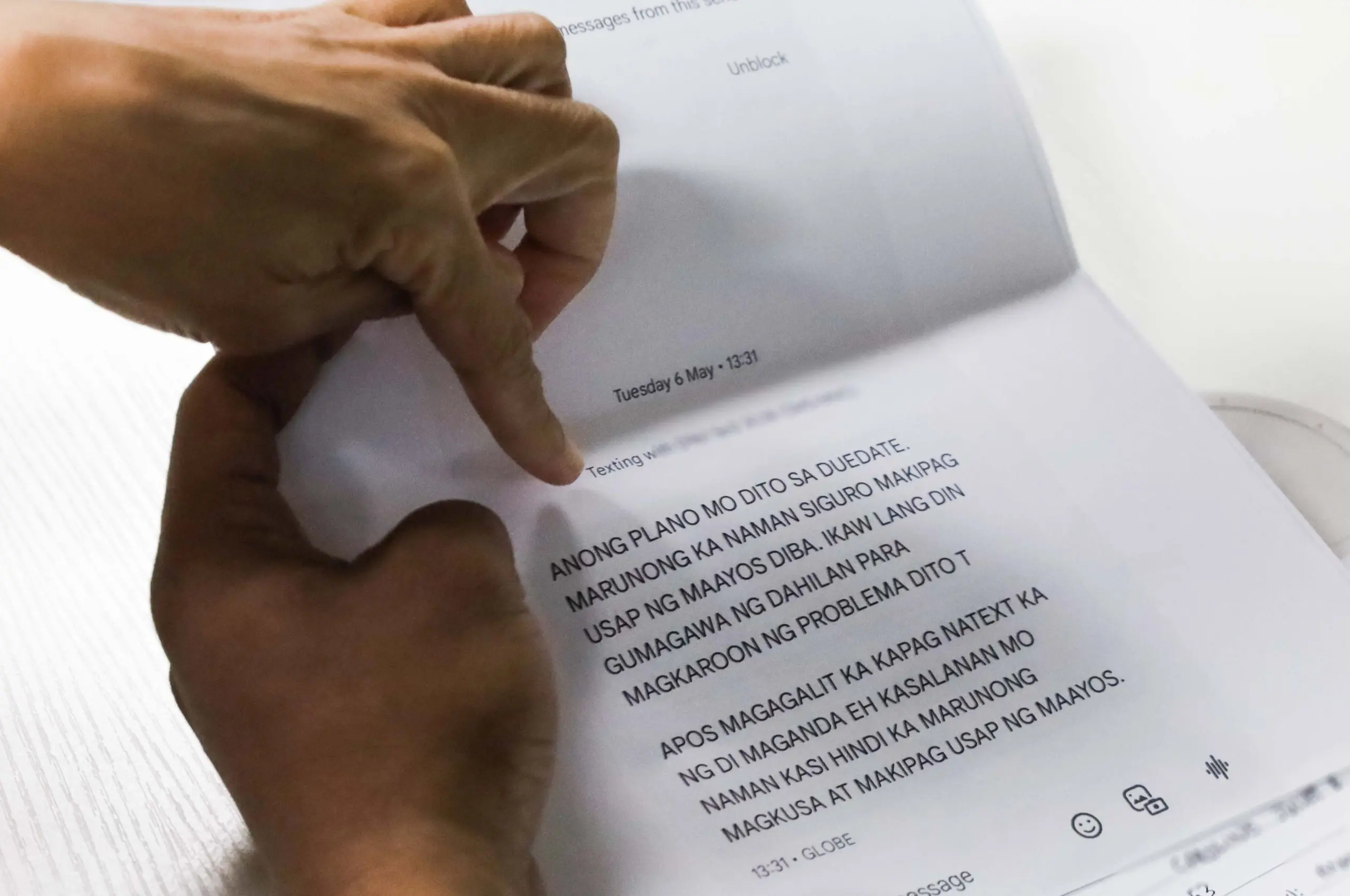

One News reports that one victim had taken out a P50,000 loan from an OLA in 2023, but only received P32,000. Since taking out the loan, her debt had reportedly ballooned to P4 million. A screenshot of a text message says the lender had already approached her Facebook friends, relatives, and colleagues regarding her loan. In another printed out screenshot, the lender allegedly sent her death threats.

“OLA operators are causing financial, psychological, and reputational injury to thousands of Filipinos through their threats and harassment,” PAOCC said in a statement.

PAOCC Undersecretary Gilberto Cruz said the agencies are also acting on a directive from President Ferdinand “Bongbong” Marcos Jr. “We are going after these groups to protect our people and ensure they are held accountable,” he said.

The SEC has warned against transacting with or borrowing from online lenders without registrations or licenses. In February 2025, PAOCC banned 89 online scam loan pages and 27 OLA administrators, according to the agency.

Meanwhile, usage of OLAs continues to rise, according to consumer finance firm Digido. Lending apps in the Philippines saw a 43 percent year-on-year increase in users in 2024, with 67.84 million new users looking for lending services.